FlaSEIA Consumer Guide

Florida Solar Energy Industries Association (www.FlaSEIA.org) is dedicated to promoting the widespread adoption of solar thermal, photovoltaic, and energy storage systems. We achieve this by educating consumers, engaging with political leaders, actively supporting and drafting legislation, and conducting business in a professional and ethical manner.

Download the guide as a PDF or read it below.

Changes to Solar Incentives

Many Florida utilities still provide true net-metering, although there is strong pressure from utility companies from every direction to end net-metering. So, if you have true net-metering (i.e., FPL and FPUC) do not expect this to last forever.

As of August 16, 2022 when The Inflation Reduction Act was signed into law the IRS federal tax credit was increased to 30% for 2022-2032 for residential and commercial solar PV and solar PV plus energy storage (batteries). For stand-alone battery projects installed in 2022 the IRS federal tax credit remains at 26%, then in 2023 it increases to 30% through 2032. Then it will step down to 26% in 2033 and 22% in 2034.

With this increase to the IRS federal tax credit for the next 10 years, now is a great time to go solar or add more solar panels or batteries to your existing system!

Solar Haven Community

Solar Haven Community Development

We are pleased to announce that A1A Solar has partnered with a development company that is moving forward with a 900-home project with commercial and retail features in North Florida. This development will have highly efficient and sustainable houses and take advantage of renewable energy, energy management, along with being EV friendly as well as water conservation technologies. This is intended to be a net-positive energy community, exporting a surplus of green electricity within its region on an annual basis.

Solar Haven Community Investment Opportunity

Funding for this project will be by sustainability-focused investors. The first funding offering is now available to the public with as little as $100 for share ownership. This first round of funding is to purchase and secure approximately 1,300 acres in Bunnell, FL. The land will collateralize the shares purchased in this funding round. If you wish to be an investor and even perhaps a future resident of this community, please go to https://wefunder.com/solarhavencommunity/buzz for more information.

Solar Incentives

Many Florida utilities still provide true net-metering, although there is strong pressure from utility companies from every direction to end net-metering. So, if you have true net-metering (i.e., FPL and FPUC) do not expect this to last too much longer.

The IRS federal tax credit is scheduled to drop from 26% to 22% January 1, 2023, and then expire in 2024 for residential solar.

The bottom line is that if you wish to go solar or add more solar panels or batteries to your existing system, right now the incentive is the highest it will likely ever be.

Act Now!

Solar laws are changing in Florida. Get grandfathered in before it’s too late!

What does HB-741 mean?

- The law was essentially written by the utility companies, who think solar is great for them, but don’t want their customers to have solar.

- The law goes into effect Jan 1, 2024

- Until then, new customers will be grandfathered in for twenty years.

- Utility companies will be able to pay a fraction of what they charge to customers who sell power back during the daytime. The initial reduction is 25%, followed by further reductions until net-metering goes away completely.

- The longer you wait, the more money you lose

- The federal tax credit is decreasing to 22%

- Supply chain issues are causing prices to increase

- Inflation is at an all-time high, causing further price increases.

- Interest rates are going up due to inflation.

- Increased demand to lock in net-metering means prices will continue to go up as we approach the deadline

- Utility companies continue to raise electricity rates

Contact us now to make an appointment

The Battle for Solar

Pete Wilking of A1A Solar has been visiting Tallahassee to fight for solar.

How Does the Solar Tax Credit Work?

Many areas of the world are experiencing warmer temperatures and more sunshine, which has fueled the increasing demand for solar panels. People are reaping the benefits of solar power by seeing reduced utility bills and receiving a tax credit, but how does the solar tax credit work exactly?

Federal solar tax credit

In general, a tax credit is a dollar-for-dollar reduction in the amount of income tax a person owes. The solar Investment Tax Credit (ITC) was enacted in 2006, and since its inception, the solar industry has grown by over 10,000 percent, investing billions of dollars into the U.S. economy and creating hundreds of thousands of jobs. The federal residential solar energy credit can be claimed on a person’s federal income taxes for a percentage of the cost of the solar photovoltaic (PV) system. The solar system needs to be placed in service during the tax year and must generate electricity for a home in the United States. As of now, there isn’t a maximum amount that can be claimed.

Federal solar panel rebate

Part of the government solar panels program is a rebate, which provides different percentages back on income tax depending on the year the solar system was installed. The following tax credits are provided:

- 26% tax credit for residential/commercial systems installed in 2020-2022

- 22% tax credit for residential/commercial systems installed in 2023

- 10% for commercial systems installed in 2023 and after

There was a federal solar tax credit extension, which provides a 26% tax credit for systems installed in 2020-2022. The credit was originally supposed to expire in 2021 and reduce to 22%.

If you’re contemplating getting a solar system installed and want to reap the benefits of a solar panel rebate, make your plans now as the solar panel federal tax credit expiration is set for 2024 unless Congress decides to renew it.

Are there other incentives?

If a rebate isn’t enticing enough, certain states offer other incentives. Oregon provides cash incentives if your system is grid-tied (most systems are), Texas has a solar rights law which prevents HOAs from banning solar systems on homes, and Illinois has a property tax break, known as the Special Assessment for Solar Energy Systems, that taxes your property as if the panels weren’t even installed so you don’t have to worry about your property tax bills increasing. The state of Florida solar incentives are similar but have some differences.

While solar energy systems are exempt from Florida’s sales and use tax, the state provides a 100% property tax exemption for residential renewable energy property, and 80% property tax abatement for commercial renewable energy property. Local incentives are also provided depending on the county in which the house or building is located.

Solar financing through lending programs is also available for homeowners and commercial businesses through Florida PACE (Property Assessment and Clean Energy). Through PACE, homeowners can finance energy-efficient upgrades at fixed interest rates with no upfront costs since it’s attached to their property taxes.

A study from Berkeley Lab found that a solar energy system can increase a home’s value by 3.5 percent. The value increase depends on the watts produced by the system, so the more watts made by a solar system, the more a home’s value will be increased.

How to file for the solar panel tax credit

When getting ready to file for the solar panel tax credit, it’s important to check that you’re eligible for the rebate. Here are three ways to check your eligibility:

- Do you own the solar system?

- Do you have a federal tax liability to use the ITC against?

- Is this system for your home in the U.S.? “Home” includes houses, houseboats, RV’s, cooperative apartments, or condos and does not have to be your main residence if you own the home and lived in it for a portion of the year.

Make sure you have your receipts from the solar installation available to submit or provide if anything is questioned. If you meet these criteria, you’ll need to find the appropriate solar tax credit form from the IRS, which is IRS Form 5695, also known as the Residential Energy Credits Form, as part of your tax return. This form is needed to calculate the number of tax credits you can gain from your qualified home energy improvements such as:

- Geothermal heat pumps

- Solar panels

- Solar batteries

- Solar thermal pool heating

- Fuel cells

- Small wind turbines

Once that is calculated, enter the result on your 1040 form. As always, it’s important to consult a certified tax professional with questions and for tax-related advice.

What is the Difference Between Renewable and Nonrenewable Resources?

Humans use both renewable and nonrenewable resources daily. But what constitutes a resource as renewable or nonrenewable? As the world continues to use more sustainable energy sources, people are finding alternative ways to fuel the world, looking to the sky, the sea, and deep within the earth. While many may be familiar with solar energy and its ability to power houses, charge cell phones and heat water, among other things, there are a variety of other resources that can yield the same results as solar, but some are renewable while others are nonrenewable. Have you ever found yourself asking the following:

- Is natural gas renewable or nonrenewable?

- Why is water a renewable resource?

- Are any resources inexhaustible?

- What is the difference between renewable and nonrenewable resources?

Keep reading to find the answers to these questions and more!

What does renewable mean?

Renewable means that it can be replenished naturally over short periods of time. There are five major renewable energy sources: solar, wind, water, biomass and geothermal. These resources are limited in their availability at any time because they come from the earth. While the sun rises each day, when it is cloudy its ability to generate power becomes limited.

What is the difference between renewable and nonrenewable resources?

While renewable resources are replenished relatively quickly, nonrenewable resources take much longer to be restored. Coal, nuclear, oil and natural gas are nonrenewable energy resources that are available in limited supplies.

You might be familiar with the term fossil fuels. Oil, natural gas and coal are fossil fuels that were formed in the earth over millions of years from dead plants and animals. Pressure and heat transformed the remains of the plants and animals into oil, which is found under many layers of rock and sediment.

Power plants that use nonrenewable resources can produce more power on demand. So, on a hot day when many people are running their air conditioners, power plant operators can increase the energy production, which isn’t possible with renewable resources.

Which resources are renewable and nonrenewable?

Is geothermal renewable or nonrenewable?

In Greek, geo means earth and therme means heat, so geothermal is heat within the earth. Heat is continuously produced deep inside the earth’s core from the decay of radioactive particles, which is a process that happens in all rocks, making it renewable. This resource is used to heat buildings, generate electricity and heat water for bathing.

Is wind renewable or nonrenewable?

Wind is a renewable resource. Wind turbines are used to convert wind into energy without releasing emissions that pollute the air or water. These turbines also reduce the electricity generation from fossil fuels, resulting in less carbon dioxide emission and lower air pollution according to the U.S. Energy Information Administration (EIA). Using wind has fewer environmental effects than other energy sources when producing energy.

Is biomass a renewable resource or nonrenewable?

An organic material derived from plants and animals, biomass is a renewable resource. Storing chemical energy from the sun, biomass is produced by plants through photosynthesis. A versatile resource, biomass can be burned directly for heat or turned into renewable liquids or gaseous fuels. Until the mid-1800s, biomass was the largest source of total annual U.S. energy consumption, and in 2020 provided 5% of total primary energy use in the United States. To this day, biomass serves as an important fuel for many developing countries for their cooking and heating needs.

Is natural gas renewable or nonrenewable?

Natural gas is formed from the remains of sea plants and animals that died 300-400 million years ago, making it a nonrenewable resource. Once natural gas is extracted, it’s sent to a processing plant so it can be cleaned and separated into methane, propane and butane. Methane comprises 90% of natural gas.

Why is water a renewable resource?

Water can be found both underground and on the surface of the earth in rivers, oceans, lakes and streams. Some of these bodies of water are replenished through snowmelt and when it rains. Here are seven other ways water is renewable:

- Water has a rain cycle. Water evaporates, condenses into droplets and then falls back onto the earth into the various bodies of water to replenish them. If theres sufficient rainfall, water remains a renewable resource.

- Water can be conserved to help replenish water reservoirs when droughts happen. Some ways to conserve water include creating a rain garden, installing a greywater system, having a water-efficient dishwasher, and more.

- Water evaporates into a liquid vapor that later condenses, turning into precipitation. According to GreenCoast, “90% of water in rivers, lakes and oceans go through such transformation, and so water can later be replenished when the vapors condense.”

- Water condenses as part of the water cycle forming clouds first and then rain, which then falls to the earth and replenishes water sources.

- Water can be recycled and used in agricultural fields and gardens, or treated and used for drinking, cooking and other residential and business complex centers.

- Water is sustainable because it can be reused, thus reducing the dependence on other natural bodies of water.

- Rainwater can be harvested and diverted back to the earth to recharge the groundwater by connecting outlet pipes from rooftops with gutters.

Is solar energy renewable or nonrenewable or inexhaustible?

Solar energy is renewable and inexhaustible. The sun is one of the most important sources of energy for life forms on earth. The energy from the sun is harnessed using a variety of technologies and converted and used in lieu of fossil fuels because it is sustainable and inexhaustible, meaning it won’t run out unlike fossil fuels that are finite. There are numerous benefits to using solar power as it reduces air and water pollution, reduces the need for nonrenewable resources and more.

Get off the Grid

Solar plus storage is smart

Solar plus storage is smart

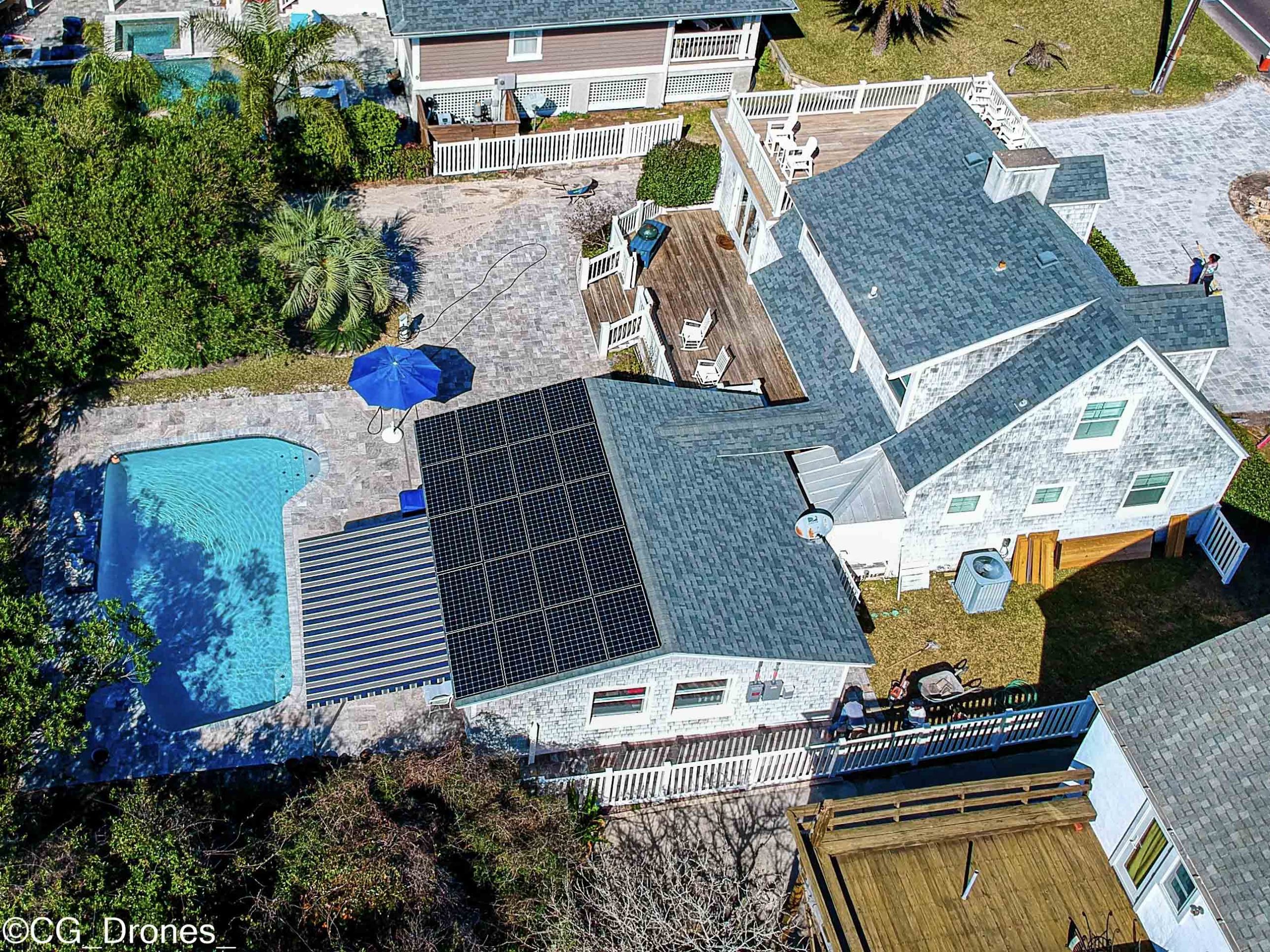

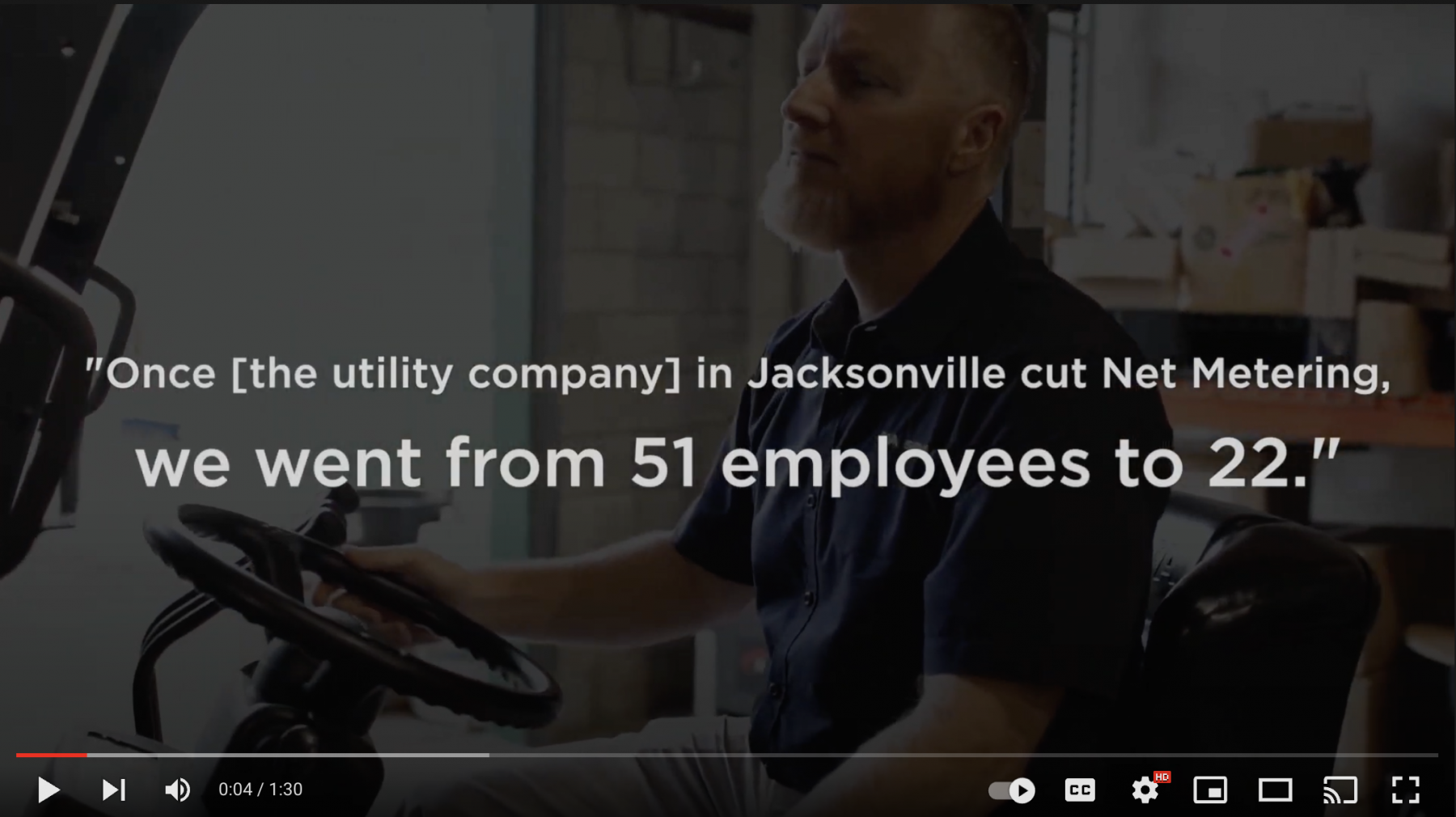

Under Florida law, privately owned utilities are required to “net-meter.” This means that they pay solar customers for excess electricity essentially the same rate that they charge them. JEA, Jacksonville’s largest utility provider, is not privately owned, and they changed their net-metering policy effective April 1, 2018. Honest solar salespeople understand the impacts of this policy shift and explains this information to new customers. Out of town companies frequently either do not know or care, and this leads to both misconceptions and disastrous results.

What does it mean?

With most systems during peak sunlight hours, between 10:00 AM and 3:00 PM solar will power the house and still be generating considerable excess electricity. This electricity has no where to go but either back to the grid, or to a battery storage unit.

If the electricity goes back to the grid, the meter will spin backwards, and JEA will credit the homeowner at 3.25 cents per kWh. They charge a weighted rate of 12 cents per kWh, though. That means they’re paying wholesale, and charging retail.

A1A Solar strongly recommends adding storage

For this reason, A1A Solar strongly recommends adding storage to new installs within JEA service area. By adding storage to the solar system, homeowners capture the excess energy during peak sun hours, and draw from the battery during the evening. This preserves the economic benefits of solar for the homeowner, and it’s good for the environment since the more energy that is self-consumed the less coal gets burned.

Solar but no battery?

Alternatively, if you elect not to install a battery system but still want solar, we can design a smaller PV system which minimizes the amount of electricity sold back to JEA. For most customers without batteries, self-consumption accounts for roughly 2/3 of solar production. For this reason, we would recommend a PV system that did not exceed 66% of your current usage. In this scenario, you would want to maximize your solar harvest by running your a/c during the day, doing laundry during daylight hours so that you would be using the electricity you are generating rather than selling it back to JEA at a reduced rate.

Many companies do not bother to tell potential customers about the impacts of JEA policy upon new solar installations, and offer blatantly misleading proposals which show a much greater offset than the customer will actually see.

A1A Solar strives to over-deliver and under-promise, and as part of this philosophy, we use sophisticated software which provides a detailed production and financial analysis for our customers.

While solar industry jobs decrease around the country, they’re increasing in Florida

Floridians love a hot summer day. “Sunny and 75” is a motto we know and love. When the weather reaches 50 degrees, we’re reaching for our winter coats. So, solar power seems like a no-brainer to meet the energy needs of any Floridian. In the last year, there has been a significant increase in solar industry jobs in Florida due to a high demand for solar energy systems. Across the rest of the nation, however, solar industry jobs last year decreased. The U.S. as a whole shows a 3.2 percent decrease in solar industry jobs, whereas the number of jobs in Florida have increased by 21 percent. The Solar Foundation believes that the decline in jobs in the U.S. came from a pause in work due to a petition about new tariffs on solar panels and cells. However, in spite of that petition, Florida is seeing more high-profile solar projects.

Floridians love a hot summer day. “Sunny and 75” is a motto we know and love. When the weather reaches 50 degrees, we’re reaching for our winter coats. So, solar power seems like a no-brainer to meet the energy needs of any Floridian. In the last year, there has been a significant increase in solar industry jobs in Florida due to a high demand for solar energy systems. Across the rest of the nation, however, solar industry jobs last year decreased. The U.S. as a whole shows a 3.2 percent decrease in solar industry jobs, whereas the number of jobs in Florida have increased by 21 percent. The Solar Foundation believes that the decline in jobs in the U.S. came from a pause in work due to a petition about new tariffs on solar panels and cells. However, in spite of that petition, Florida is seeing more high-profile solar projects.

Florida is now in second place for states with the highest number of solar industry jobs, with 10,358 people employed in the solar energy industry. California is first, with 76,838 people working in solar-related jobs.

Statisticians predict solar industry jobs will continue to increase in Florida over the next few years. JEA has planned for five new solar facilities by 2022, and it plans to increase its solar capacity from 39 megawatts to 289 megawatts by that time. JinkoSolar will employ 200 people at its new plant at Cecil Commerce Center. Another solar employer is Florida Power and Light Co., which has 18 plants in Florida.

Despite current trends across the U.S., The Solar Foundation shared a report that predicted jobs in the industry will increase in 2019 by 7 percent. And by 2026, employment in the solar energy industry will increase by 63.4 percent.