Solar tax credit: Why 2019 is the year to think wise and solarize

Why 2019 is the year to think wise and solarize to save big on your taxes.

In 2005, Congress passed the Energy Policy Act, a law that, among other things, allows a federal tax credit for up to 30 percent of the cost of a new solar energy system for a commercial or residential property, including installation fees. Originally set to expire in 2007, the credit now extends until 2021 for residential solar energy systems, with benefits for commercial solar energy systems continuing beyond 2022. However, there’s a catch. Starting in 2020, the amount you can save on a newly installed solar energy system will decrease. This year is the last year you can get the full 30 percent federal tax credit. The percentage decreases year over year until 2022, when those with new residential solar energy systems get no federal tax credits at all. New commercial solar energy systems will get 10 percent. Federal tax credit value per year for solar energy systems:- 2019: 30 percent for new residential or commercial

- 2020: 26 percent for new residential or commercial

- 2021: 22 percent for new residential or commercial

- 2022 and on: 0 percent for new residential, 10 percent for new commercial

Solar energy batteries are getting less expensive

Now is the time to purchase a backup battery for your solar energy system

A solar energy battery is a wise investment for anyone with a solar energy system, as it allows your system to keep operating when the sun isn’t providing enough energy on its own. In the beginning of 2010, solar energy batteries were rare to see with solar energy systems. Now, most solar system owners have a backup battery. What changed?

Originally, few people purchased solar energy batteries because they were expensive. Then, around the mid-2010s, solar battery prices began dropping dramatically. While there isn’t any solid data yet, many believe the price decrease was due to a huge spike in demand for solar energy systems. As more people purchased systems for their homes and businesses, they realized they needed a backup battery to keep their systems running without interruptions.

Why did the demand for both solar energy systems and batteries increase? Home and property owners wanted to save money on their utility bills and through tax breaks. There was also a trend toward being more environmentally friendly. What better way to reduce your carbon footprint than by having an energy system that draws power straight from the sun, instead of relying on coal-powered energy plants?

Thanks to the popularity of solar energy systems, it’s more affordable than ever to have a solar energy battery. It’s the best time to get one.

A solar energy battery is a wise investment for anyone with a solar energy system, as it allows your system to keep operating when the sun isn’t providing enough energy on its own. In the beginning of 2010, solar energy batteries were rare to see with solar energy systems. Now, most solar system owners have a backup battery. What changed?

Originally, few people purchased solar energy batteries because they were expensive. Then, around the mid-2010s, solar battery prices began dropping dramatically. While there isn’t any solid data yet, many believe the price decrease was due to a huge spike in demand for solar energy systems. As more people purchased systems for their homes and businesses, they realized they needed a backup battery to keep their systems running without interruptions.

Why did the demand for both solar energy systems and batteries increase? Home and property owners wanted to save money on their utility bills and through tax breaks. There was also a trend toward being more environmentally friendly. What better way to reduce your carbon footprint than by having an energy system that draws power straight from the sun, instead of relying on coal-powered energy plants?

Thanks to the popularity of solar energy systems, it’s more affordable than ever to have a solar energy battery. It’s the best time to get one.

Solar as an investment

Why investing in solar panels can get you free electricity and more

What’s one of the biggest reasons people make the switch to solar-powered energy? To save money, of course! Having a residential or commercial solar energy system allows you to avoid nearly every added cost and fee that utility companies require.

On average, FPL customers pay $211 every month to power their homes and businesses. Electric bills include hidden or added fees like storm charges, franchise charges, utility taxes, and discretionary sales taxes. These fees pile up month by month and can be frustrating for families or businesses on a budget.

Choosing to go solar is a smart investment that will save you both money and energy. Once you install a system, you’ll immediately see a decrease in your electric bill. According to SolarReviews, solar power users see an average of a $24 decrease in their monthly electric bills after installing solar panels.

While you’ll consume most of the energy that the panels produce, your system absorbs any unused energy and sends it back to the grid. You’ll receive credit for every excess kilowatt hour on your FPL bill through its buyback program, saving you even more money!

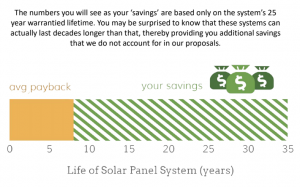

The system eventually pays for itself over time, and then you’re producing your own power at little to no cost for the entire lifetime of the system.

If you’re still not sure if solar is right for you, here are more reasons going solar is an investment to consider for your home and business.

Rooftop solar panels increase northeast Florida home values

Study shows a solar energy system will increase your home’s resale value by 3.5 percent

There is no doubt that solar energy systems offer a multitude of benefits. Beyond being good for the environment and providing savings on utility bills, solar panels also increase a home’s value. In the past, there hasn’t been sufficient research to enable appraisers and real estate professionals to confidently value homes with solar panels. However, in recent years, new studies have offered data that proves homebuyers are willing to pay more for a home with a solar energy system across a variety of states, markets, and home types.

According to a study from Berkeley Lab that spanned eight states, including Florida, a solar energy system can increase the value of your home by a 3.5 percent increase. The study suggests that the increased value for your home depends on the watts the system produces. The more watts your solar energy system makes, the more it will increase your home’s value. Therefore, a larger investment in a solar system will pay out more when it comes time to sell your home.

In the study, homeowners owned rather than leased their rooftop solar systems. The homes were less than $900,000, and researchers used methods to account for neighborhoods, models, and market characteristics.

Berkeley Lab’s research shows that a solar energy system would be a wise investment for your home – for monthly energy cost savings as well as for the increase in the value of your home.

How solar energy has evolved over the past 5 years

A1A Solar shows you why now is a great time to go solar

It’s no secret that the rooftop solar industry is constantly evolving. The good news is that time has brought positive changes for solar energy. Over the last five years, rooftop solar panels have increasingly become more efficient and affordable. Improvements in the industry mean more benefits for customers.

It’s no secret that the rooftop solar industry is constantly evolving. The good news is that time has brought positive changes for solar energy. Over the last five years, rooftop solar panels have increasingly become more efficient and affordable. Improvements in the industry mean more benefits for customers.

Improvements and efficiency

Technological advancements are responsible for better, more reliable solar photovoltaic (PV) systems. Five years ago, the most efficient solar panel you could purchase was 17.8 percent efficient. Now, solar panels ranging from 20 percent to 23 percent efficient are readily available to homeowners.

In comparison to the heavy, hard-to-manage systems of the past, modern solar panels produced in the past five years are lighter and do not require as much rewiring or hardware to install. This leads to quicker, one-day installations for homeowners and business owners.

New technologies in solar energy

- sonnenBatterie: This smart and reliable energy system provides backup power and also maximizes solar use every day of the year. The sonnenBatterie allows customers to continue using their solar panels even when the grid goes down.

- Flexible printed solar panels: Industrial printers started manufacturing solar cells as thin as paper in 2015. The printed solar panels are flexible, produce up to 50 watts per square meter, are inexpensive to make and have 20 percent conversion efficiency. However, the printed panels are still undergoing testing since they’re highly susceptible to moisture problems and could result in lead contamination if broken.

- Microinverters: A new alternative to traditional inverters, microinverters improve the efficiency of a solar system by converting the electricity supplied by each panel individually.

Falling prices in the solar industry

According to the Solar Energy Industries Association, solar prices have dropped 55 percent over the last five years. Over the past decade, the average gross cost for a standard 6-kilowatt home solar system has decreased from $52,920 to $20,160. Quicker installation times helped contribute to the fall in prices. The overall reduction of prices enables the industry to expand into new markets and deploy thousands of solar systems throughout the nation. In Florida, A1A Solar Contracting is the No. 1 residential rooftop solar contractor, according to Solar Power World Magazine.

Lawrence Berkeley National Laboratory’s report reveals that since 2012, module prices have stayed relatively stable while installed prices have continued to decline. Because the price of solar panels themselves has not changed much during this time, this means that the drop in installed cost was the result of a decline in the cost of inverters that convert solar power to AC power as well as other factors such as installation and system design.

Converting to solar energy

With efficiency increasing, more power is produced in less space. This is great news for homeowners and business owners because it means fewer panels to purchase, more energy and more savings!

Solar power for your home is more attainable today than ever before.

What’s the deal with solar roof tiles?

A1A Solar gives you the facts about solar energy

Information about solar roof tiles is all over the news and social media lately. You may be wondering what all the fuss is about and what’s really going on with this technology.

Information about solar roof tiles is all over the news and social media lately. You may be wondering what all the fuss is about and what’s really going on with this technology.

Although solar power has been around for more than 100 years, it’s only been in the last few decades that people have begun to use it on a global scale. If you’re among those who are just waking up to the benefits of rooftop solar, now is a good time to discover what’s new and how you may be able to take advantage of this important trend.

Understanding rooftop solar

Solar energy is abundant as long as the sun is shining. Researchers at Bell Laboratories created the first silicon solar cell in the 1950s to harness a significant amount of that energy. Their work was the precursor to the modern rooftop solar tiles used to produce energy for homes and businesses today.

The sun hits your roof with photons. Rooftop solar panels convert those photons into electrons of direct current. These electrons flow out of the panels into an inverter, which changes them from DC power, like that found in batteries, to AC power, which is the kind that powers your television, appliances and other devices.

How much do solar panels cost the consumer?

A rooftop solar system is an investment that will serve your home and family well into the future. However, the steep, upfront cost may make them seem prohibitive.

Purchasing a system can cost $15,000 to $20,000. The actual cost depends on the orientation of your roof and how many panels you’ll need. Since solar panels will significantly reduce your energy bill by 70 percent or more, a solar system will pay for itself in five to seven years.

Leasing your system is an option, however, there are numerous disadvantages. For example, the leasing company may control how many panels they install and where they install them. Also, if you decide to sell your home before the lease is up, buyers may not be willing to assume the payments. You are better off purchasing, so you get the tax credits and other savings.

What’s all this about the Tesla solar roof and when will it be available?

One reputed drawback of rooftop solar panels is their appearance. In other words, people think they’re unsightly and choose to forego them despite the sizeable energy savings.

Tesla, an American automaker, energy storage company and solar panel manufacturer, has created a system using a high-efficiency solar cell created by Panasonic. These cells are designed to blend into the roof because they look like regular roof tiles. They come in different styles so you can integrate them into any type of roof.

On the downside, the sticker price is pretty substantial. For the average home, the cost of the Tesla solar panels is approximately $40,000 to $60,000. Some people have already made down payments on these systems, expected for delivery in 2018.

Is rooftop solar right for you?

With energy costs rising each year, everyone should be looking to save money. Rooftop solar panels represent a clean, cost-effective way to lower your bills and to help the environment by using a renewable energy source.

Improved technology has made solar power more affordable than ever. Researchers estimate that 700,000 U.S. homes are now reaping the benefits of rooftop solar.

Turn on the tax savings with solar energy

Discover how much you can save on your taxes when you install a solar system

Installing a solar energy system helps save the environment. Did you know it also saves you money on your federal taxes? Under the Consolidated Appropriations Act, you can claim a tax credit for up to 30 percent of the cost to install a solar energy system. However, the amount you claim depends on when you installed your system.

Installing a solar energy system helps save the environment. Did you know it also saves you money on your federal taxes? Under the Consolidated Appropriations Act, you can claim a tax credit for up to 30 percent of the cost to install a solar energy system. However, the amount you claim depends on when you installed your system.

- If you install a system before Dec. 31, 2019, you’ll get a 30 percent credit.

- If you install a system between Jan. 1, 2020 and Dec. 31. 2020, you’ll get a 26 percent credit.

- If you install a system between Jan. 1, 2021 and Dec. 31, 2021, you’ll get a 22 percent credit.

Unfortunately, Florida doesn’t have a state tax credit system in place for in-home solar energy systems. However, you won’t have to pay sales tax if you get a property tax exemption on the solar energy system installed on your home or property.

If you’d like to save the most on your taxes when you install a solar energy system, it’s best to do it before Dec. 31, 2019. When you’re ready to harness solar energy for your home, call us at 904-GOT-SUN1 (468-7861), and we’ll be happy to set up a solar energy system for you.

New data on home premiums could change your mind about rooftop solar

A1A Solar provides the information you need to know

How much is your home truly worth? When you make home improvements, will you reap a fair return on your investment? If you install energy-saving rooftop solar panels, the answer is yes; they do increase your home’s value. And now, there is proof.

Researchers from the Lawrence Berkeley National Laboratory (LBNL) and other institutions have completed the most comprehensive study ever on home premiums and the true value of rooftop solar panels. The study spans more than 10 years and eight states and determined that solar photovoltaic (PV) systems progressively add value. This data is very valuable for real estate agents, appraisers and homeowners.

How researchers collected data

Limited studies in the past have suggested an increase in PV home premiums, but the information hasn’t really trickled down to make an impact on the housing market. The ability to value these homes appropriately will have a significant impact in the PV housing market nationwide.

Using data from LBNL’s Tracking the Sun report as well as real estate information and comparisons with non-rooftop solar homes, the researchers conducted the study to help fill in the gaps of understanding what all the information means for housing markets and homeowners. They studied homes in Connecticut, California, Massachusetts, Florida, Maryland, North Carolina, New York and Pennsylvania.

In the study, homeowners owned rather than leased their rooftop solar systems. The homes were less than $900,000 and researchers used methods to account for neighborhoods, models and market characteristics. You can learn more at https://www.energy.gov/eere/sunshot/sunshot-initiative.

The findings

- Homebuyers are consistently willing to pay more for homes with rooftop solar panels.

- The increase in value extends across various states and home types. This is for both newly built homes and those that were not new when rooftop solar was installed.

- Photovoltaic systems can save homeowners up to $4 per watt or approximately $15,000 for many homes.

- Homebuyers get double rewards. In addition to the energy savings achieved by solar panels, they may also receive tax credits.

- Besides helping you sell your home for more money, rooftop solar panels can also be a factor in selling your home faster.

- You can experience a possible 200 percent return on investment, which more than makes up for the cost of solar panel installation. By contrast, most kitchen remodels fetch about 60 percent return.

How the study helps homeowners

When buyers and real estate professionals better comprehend the value of rooftop solar systems, home prices will be more rational, based on data instead of conjecture. Additionally, the more people understand the effect on home premiums, the more they will be willing to invest in rooftop solar.

As an added benefit, the popularity of rooftop solar may continue to bring costs of installation down. With attractive, innovative financing options, rooftop solar systems are more affordable than ever before.

There are now more than half a million U.S. homes enjoying the benefits of rooftop solar. If you decide that it’s for you, make sure you hire someone certified and experienced for maximum benefits when buying or selling your home.

Other benefits of rooftop solar installation

Even if you never decide to sell your home, rooftop solar panels have numerous other benefits. For instance, as utility rates rise, your electricity bill savings increase. In fact, you’ll begin to see energy savings immediately, before you pay your next bill.

Also, sunshine is free and abundant. The more homeowners turn to rooftop solar, the less we rely on fossil fuels. This leads to better health, cleaner air and more green jobs.

Save 30% on your new PV system- here’s how!

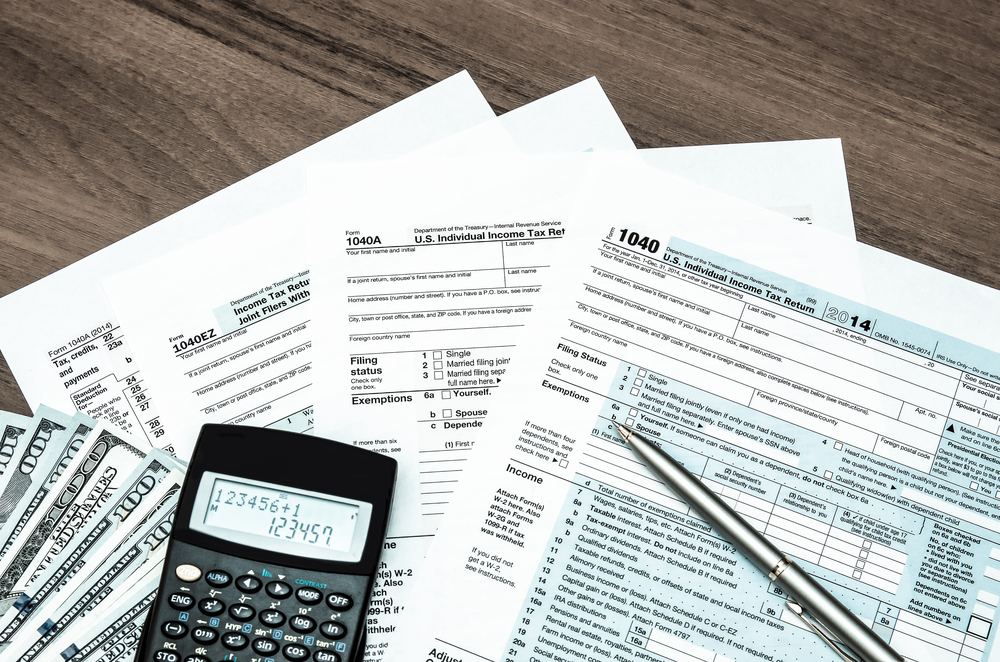

The Investment Tax Credit, or ITC, is a 30% tax credit for residential clean energy improvements. The Energy Policy Act of 2005 states that a taxpayer may claim a credit or 30% of qualified expenditures for a system that serves as a dwelling unit located in the U.S. That is owned and used as a residence by the taxpayer. This is a credit to taxes owed, not a deduction to earnings. This is a dollar-for-dollar reduction in the federal income taxes a homeowner would otherwise pay to the IRS. The amount of the tax credit which can be utilized depends on the homeowner’s total tax liability. In the event that the amount of the tax credit exceeds liability for that year, the customer is able to carry-over the

credit to subsequent years. The tax credit is available on qualified installs before 2021.Line 63 of tax form 1040 will tell you what your total tax is, assuming you haven’t had a significant change in circumstance (new job, loss of a job, sale of a home). If you’re paying the amount of the tax credit in taxes, you can expect to receive that amount back in the form of an IRS refund. If you have questions, it’s always best to consult with your CPA, since everyone’s tax situation is different. If a person owes zero federal taxes on an annual basis, this tax credit will NOT be paid as a grant from the IRS.

What does “carry-over mean?”

In the event that your tax credit exceeds your tax liability, the credit will carry over to subsequent years, meaning you will get the remainder of the tax credit back in the form of a refund check for the next year(s). In most cases, homeowners are able to take advantage of the full tax credit the first year, but not always. Even if you can’t claim the full credit the first year, the economics are still strongly in your favor, considering the long-term savings solar will provide.

Examples:

Value of solar property: $40,000

IRS 30% tax credit: $12,000

- Scenario 1: Tax credit is equal to tax liability

- If the homeowner paid $1,000 per month in payroll taxes, and this is the tax liability, then the homeowner can expect a tax refund of $12,000.

- Scenario 2: Tax credit is less than tax liability

- If total tax liability is $18,000

- IRS tax credit $12,000

- Tax liability after solar $6,000

- Tax refund. $8,400

- Scenario 3: Tax credit is MORE than liability

- Total tax liability before solar: $5,000

- IRS tax credit: $12,000

- Tax liability: $0

- Carry-forward credit: $7,000

In this scenario, the taxpayer only owes $5,000 in taxes, but the tax credit exceeds the amount owed by $7,000. This credit can be claimed the following year, and will come back in the form of a refund, assuming that the taxpayer’s financial situation does not change. If the tax credit is more than your tax liability, it’s important to know this when arranging your financing. Typically, we finance the amount of the tax credit with a same-as-cash loan for either 12 or 18 months. This allows you to make no payments, while awaiting your tax refund. But if the loan amount exceeds the amount of the tax refund, you could find yourself in a bind, so it’s crucial that you know your tax liability before the financing is arranged.

Weather any storm outage with a reliable battery solution

Did you know that your solar panel and wind-powered systems won’t work if the power goes out during rough weather conditions? That is, unless you have a backup battery.

Did you know that your solar panel and wind-powered systems won’t work if the power goes out during rough weather conditions? That is, unless you have a backup battery.

A solar photovoltaic (PV) system plus a lithium-ion battery backup bank plus an optional generator gives your family off-grid security when accidents, blackouts and natural disasters strike.

Battery systems provide improved energy security, and a custom design and installation meets your needs by providing the ideal power system. Now, new and existing PV customers can continue using their solar and wind-powered systems and keep the lights on when the grid goes down.

Florida consumers can now benefit from the sonnenBatterie, a smart and reliable energy storage system. The sonnenBatterie goes beyond backup power – it maximizes your solar use every day, thus saving you money and amplifying your investment in clean energy.

Benefits of the sonnenBatterie

[arve url=”https://www.youtube.com/watch?v=7HIIkOBo4t4″ align=”right”/]

- Keeps solar modules producing power despite loss of grid power

- No annual maintenance

- Lasts 20 years

- No ventilation required

- Clean, all-in-one design

- Monitors energy usage

SonnenBatterie options include:

- Eco – The sonnenBatterie eco is an energy storage solution that utilizes intelligent energy management software. It is available in a variety of storage capacities and configurations, allowing for extensibility and expansion. It features a continuous output of 3,000–8,000 W with a usable capacity of 4–16 kWh (in 2-kWh increments).

- Pro – This is the new standard for reliable peak shaving for hotels, restaurants and office buildings of any size. The modular design makes it easy to size the system for any facility. This design features output with a peak of 30 kW (repeatable to 90 kW) and weighs approximately 370 lbs.

- Dimensions WxHxD: 28x55x25 inches

- Maximum efficiency of inverter: 96%

- Ambient temperatures: 41–95° F

- Enclosure rating: NEMA 12 AC

Customer feedback

“When the grid went down for four days, the sonnenBatterie eco 10 system in combination with my 10 kw solar panel system kept my power running and helped us comfortably weather Hurricane Hermine.” – Jim McBrayer